Election Time: Why It’s a Strategic Period for Investment Opportunities.

Worried About A Trump Or Harris Election Win? Here's How The Stock Market Could React, What To Do Now Today

As election time approaches, financial markets can experience significant shifts, bringing potential investment opportunities across various asset classes. Here’s why this time of year may be ideal to consider investing in stocks, bonds, real estate, gold, and commodities.

1. Stock Market: Opportunity in Volatility

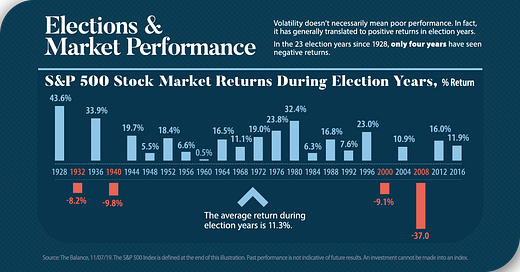

Elections often create market uncertainty as investors anticipate changes in economic policy, which can lead to increased market volatility. While this might sound risky, volatility can present buying opportunities, especially if strong, fundamentally sound companies see temporary price drops.

Why Consider Stocks: Market fluctuations during election seasons often reflect speculation rather than long-term fundamentals. These price swings can allow investors to buy quality stocks at discounted prices, especially in sectors likely to benefit from future policies.

Sector Opportunities: Keep an eye on sectors that align with potential policy changes. For example, renewable energy, healthcare, and technology sectors might experience movement depending on policy proposals.

Strategy Tip: Dollar-cost averaging during election volatility allows investors to invest gradually, reducing the impact of short-term price swings on their portfolio.

2. Bonds: Safe Haven with Potential Upside

Bonds are often viewed as a safe-haven asset during times of uncertainty, which can make them appealing during election seasons. Additionally, changes in interest rate expectations can impact bond prices, as elections often influence monetary policy perspectives.

Why Consider Bonds: Government bonds, particularly Treasury bonds, provide stability and can be a good hedge against stock market volatility.

Corporate Bonds: High-quality corporate bonds might also become more attractive, especially if the market expects favorable economic conditions post-election.

Strategy Tip: Consider a bond ladder—a strategy that staggers bond maturities over time—to manage interest rate risk and maintain a steady income stream regardless of market fluctuations.

3. Real Estate: An Investment with Tangible Benefits

Real estate can be a stable investment option during election periods, as property markets tend to be less sensitive to political shifts than stocks or commodities. Real estate prices are influenced by interest rates, economic conditions, and supply-demand factors, all of which may be indirectly affected by election outcomes.

Why Consider Real Estate: Low mortgage rates, which are often influenced by central bank policies around election time, make financing real estate investments more affordable.

Potential Tax Benefits: Real estate investments often come with tax advantages, such as deductions for mortgage interest and property taxes, which can be favorable regardless of policy changes.

Strategy Tip: Consider income-generating real estate, like rental properties, to create a consistent cash flow that can withstand economic fluctuations, offering both immediate income and long-term appreciation.

4. Gold: The Ultimate Safe-Haven Asset

Gold has long been considered a store of value and tends to perform well in times of economic and political uncertainty. Investors often turn to gold as a hedge against inflation and currency fluctuations, both of which can be influenced by election outcomes.

Why Consider Gold: Election periods can lead to increased gold demand as investors seek to safeguard their portfolios. Gold’s performance is often inversely related to the dollar, which may experience fluctuations based on political sentiment.

Portfolio Diversification: Gold is less correlated with stocks and bonds, making it a valuable diversification asset.

Strategy Tip: Consider a small allocation in physical gold, gold ETFs, or gold mining stocks as a way to balance your portfolio during uncertain times.

5. Commodities: Benefit from Policy-Driven Demand Shifts

Commodities like oil, agricultural products, and metals are influenced by policy changes related to trade, environmental standards, and infrastructure spending. As political campaigns discuss potential policy shifts, commodities can see shifts in demand projections.

Why Consider Commodities: Policies that focus on infrastructure, manufacturing, or renewable energy can drive demand for certain commodities, such as copper (used in electronics and renewable energy projects) or oil (subject to energy policy changes).

Inflation Protection: Commodities tend to perform well in inflationary environments, which are sometimes influenced by election-related economic policies.